Oracle FLEXCUBE: The Shift in Core Architecture

The recent architectural changes in Oracle FLEXCUBE 14.6 have had me thinking, about whether the decision by Oracle to break down its monolithic Core ... Read More

Découvrez pourquoi Eclipsys a été nommée 2023 Best Workplaces in Technology, Great Place to Work® Canada et Canada's Top 100 SME !

En savoir plus !The business of consumer banking has long been owned and operated by financial institutions that have been working very hard to keep up with the constantly growing consumer expectations and advancements in technology. Although financial institutions have succeeded in providing their customers with proprietary mobile and online banking channels to operate and manage their portfolios, the modern-day customer is still spending more time and money when it comes to personal budgeting, financial product comparison, and proving their creditworthiness to loan providers, especially if they have a diverse and distributed financial profile. It gets complex and therefore financial data consolidation and management is often outsourced! So, there is a growing need for digital solutions that can enable a customer, to increase control over their financial information and make healthier financial decisions.

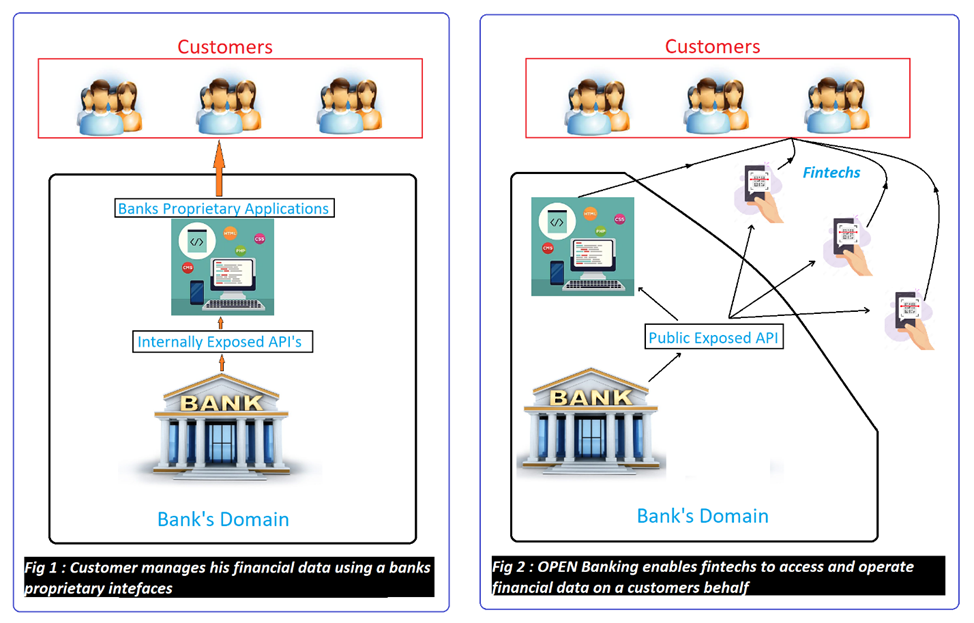

Open Banking is the concept of allowing accredited third-party service providers open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through the use of Application Programming Interfaces (APIs) which would enable developers to build applications and services.

Open banking holds the potential to reduce costs, improve a customer’s ability to manage financial services, and gain access to a wider range of services that the digital economy has to offer. This approach would ultimately give ownership of data to the consumer and provide them with a framework that would enable them to make well-informed financial decisions. This would ultimately change the payments landscape by transforming the way people transact, save, borrow, invest, and manage their finances. Lenders would get a 360-degree view of their consumer’s financial situation through a comprehensive view of their finances, helping them assess the risk level and offer optimal account terms.

With the customer’s consent, FinTechs would be able to offer a customer a wide range of services, some of them listed below.

| Account Aggregation & Management | Consolidating all bank accounts and products to manage over a single dashboard offering you a 360degree of your portfolio. |

| Instant Loans | With better access to a customer’s Creditworthiness, institutions could pre-approve loan applications and credit approvals with improved |

| Subscription Management | Manages all the recurring payments from the customer and shows them in one interface. |

| Opening new accounts | Opening new accounts digitally is a customer’s first interaction with the bank, The KYC process is expedited with customer authentication using APIs, so expectations on speed and user experience will be high for some customer segments. |

Open banking is a world citizen. The concept is spreading like wildfire across continents and each time it changes territory it takes on a different form. While researching this topic the statics I came across were mind-blowing.

|

US/CANADA Open banking is not currently available in USA/Canada.

|

Across the GLOBE

|

Since 2018, Canada has been on a long, delay-ridden journey to implement open banking. On March 22, 2022, Abraham Tachjian was appointed as Canada’s open banking lead and responsible for developing an accreditation framework for the open banking system. Open Banking is expected to arrive in Canada in 2023.

______

Sources :

https://www.canada.ca/

https://ottpay.com/

https://www.openbanking.org.uk/

https://www.wamda.com/

https://nordigen.com/

https://www.pwc.com/

The recent architectural changes in Oracle FLEXCUBE 14.6 have had me thinking, about whether the decision by Oracle to break down its monolithic Core ... Read More